Number of new companies at previous year’s level

The number of new companies remained roughly at the level of 2023. The largest number of registrations were new limited liability companies and private traders.

The average processing time of business start-up notifications remained unchanged at eight days. There was a clear speed-up in the processing of notifications concerning persons responsible for the company or bodies of the company: on average, they were processed in almost one day.

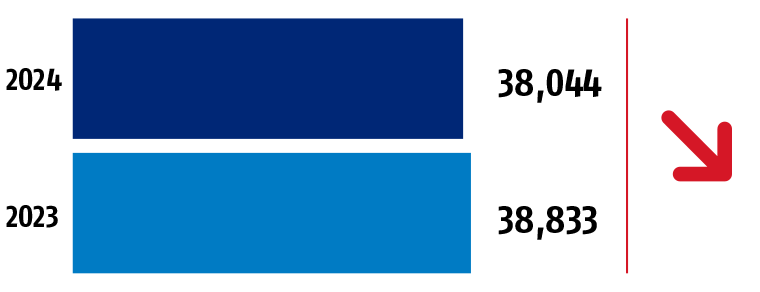

Number of start-up notifications at previous year’s levels

The number of start-up notifications received by the Trade Register was approximately at previous year’s levels: In 2024, they totalled 38,044 compared to 38,833 in 2023.

Processed start-up notifications

There was a slight increase in the number of processed start-up notifications. In 2024, we processed 38,547 start-up notifications compared to 37,974 in 2023.

Processed notifications of changes

The number of processed notifications of changes decreased somewhat. In 2024, we processed 256,722 notifications of changes compared to 271,903 in 2023.

Processed notifications of beneficial owners

There was a marked increase in the number of processed notifications of beneficial owners. In 2024, we processed 66,502 notifications of beneficial owners compared to 51,233 in 2023.

Enterprise mortgage affairs

The number of enterprise mortgage matters submitted to the Trade Register remained at previous year’s levels. In 2023, they totalled 4,120 compared to 4,238 in 2023.

Development of online services continued

We continued to develop the online services of the Trade Register. The reform of the filing service (the online service at ytj.fi) progressed so that during the year we completed the first version of the new service for notifying changes of housing companies and mutual real estate companies. It was introduced in January 2025.

We launched a comprehensive reform of the information service system of the Trade Register, the Register of Foundations and the Register of Enterprise Mortgages. The new information service will be introduced in 2026.

We renewed the PRH open data service for application developers and expanded the amount of information available there. Information on registered trade register notifications and basic information on companies in the Business Information System at ytj.fi can be retrieved from the interfaces of the service.

We developed an information service that provides information on beneficial owners. The beneficial owner information service is only intended for authorised specialists who have a purpose for accessing the information in accordance with the Money Laundering Act. Those subject to the reporting obligation under the Money Laundering Act will have access to the service at the end of 2025.

Amendments to the Trade Register Act

Amendments to the Trade Register Act were prepared, which entered into force at the beginning of 2025.

For example, the obligation to check register data annually concerning limited liability companies and co-operatives was postponed to start in 2027.

In addition, the act was amended so that companies removed from the Trade Register from 2023 can apply to the PRH for return to the register. Before the legislative amendment entered into force, a company removed from the register from 2023 had to appeal to the Helsinki Administrative Court to appeal against the deletion decision.

Due to the preparation of the legislative amendment, we suspended five deletion proceedings, which had not yet progressed to the removal of the companies from the register. Limited liability companies and co-operatives had been included in these proceedings that had not provided their financial statements or beneficial owner information within the deadline.

Work to make digital financial statements more common continued

Our goal is to increase the share of digital financial statements so that more companies would be obliged to disclose digital financial statements. This year, we had an active dialogue with the Ministry of Economic Affairs and Employment.

Until now, it has been possible to submit digital financial statements to the Trade Register through an interface offered by the PRH. In the past year, we developed alternative solutions to enable the reporting of digital financial statements regardless of the company’s way of producing the accounting.

An experiment carried out with the Real-Time Economy project examined how financial management software providers can produce digital financial statements and transfer data to the Trade Register with as much automation as possible through an interface. Based on the experiment, the amount of resources needed was moderate and the implementation was fairly simple.

We continued preparations to receive sustainability reports submitted by large companies as part of their digital financial statements. The obligation for listed and other large companies starts gradually. The first sustainability reports will be received in 2025.

We increased automated decision-making

In automated decision-making, a notification is processed using automated data processing without the person processing the case separately reviewing and approving the decision. For example, a significant number of notifications by persons responsible for the company or by bodies of the company can now be resolved through automated decision-making.

Read more:

We promoted the timeliness of information

During the year, we took various measures to improve the up-to-dateness of trade register data. Among other things, we urged thousands of companies to report their financial statements and beneficial owner information under the threat of deregistration from the Trade Register.