Steadily balanced finances

We achieved the targets agreed with the Ministry of Economic Affairs and Employment for 2024 almost in full. The number of notifications and applications remained high. The revenue from application and notification fees remained below the budgeted level, but the PRH’s finances are currently in balance.

However, forecasts for economic development in the next few years seem to make the financing situation more difficult. Central government savings have also been directed at the operating costs of the PRH. The ever-increasing demands for developing services and functions mean a need for system investments and the subsequently increasing maintenance costs. It is not possible to finance all investment needs with the current fees for applications and notifications.

The income for 2024 (including net income €54.1 million and appropriations from the Budget €14.3 million) totalled €68.4 million while expenditure amounted to €58.7 million.

Financing structure

The PRH is a net-budgeted agency. This means that most of our operating costs are covered with the fees that we charge for such work as the processing of notifications and applications and for information services. By law, the fees must cover the expenditure incurred by the PRH in carrying out its tasks.

The PRH received €3.2 million in appropriations to cover expenditure arising from the processing of matters related to associations and religious communities. The services performed for these customers are priced below cost for social policy reasons.

The PRH was also granted appropriations for the oversight of foundations (€1.7 million), maintenance of the register of industrial property rights (€80,000) and the monitoring of collective copyright management (€120,000).

The PRH also had access to an appropriation of €2.3 million to cover the costs of auditor oversight and €4.1 million for the compensation of loss of income caused by the unitary patent. €2.8 million was received for the development of the Trade Register.

A deferrable appropriation of €1.4 million from 2022 and €900,000 from 2023 were available for the Real-Time Economy project.

In addition, the PRH used €2.6 million in deferrable appropriations for 2022 for the construction of the beneficial owner register and €45,000 for productivity promotion.

Total operating income and expenditure

The income for the financial year was €54.2 million, which is about three million higher than in 2023.

The increase of the total revenue is mainly due to the increased volume of handling fees in the Trade Register.

Total operating expenditure excluding depreciation amounted to €59.4 million, which was €1.3 million higher than in the previous year. The highest increase was recorded in staff expenses, which rose by €900,000. Purchases of services remained at the same level as in the previous year.

Depreciation increased from the previous year, mainly due to the completion of large investment projects and the activation of new systems in 2023. Depreciation increased by €800,000 in the Enterprises and Corporations result area and by €400,000 in the Patents and Trademarks result area.

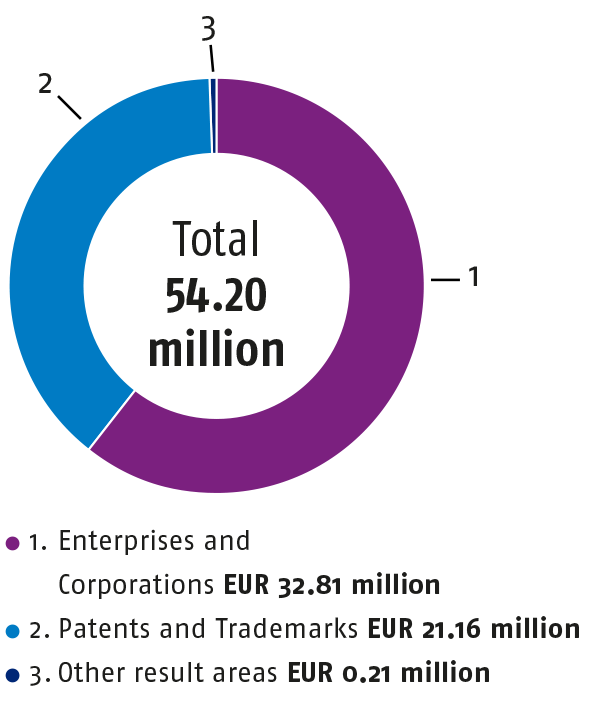

Breakdown of income by result area in 2024

Income from operations totalled €54.2 million in 2024 and it was divided by result area as follows:- Enterprises and Corporations €32.81 million

- Patents and Trademarks €21.16 million

- Other result areas €0.21 million

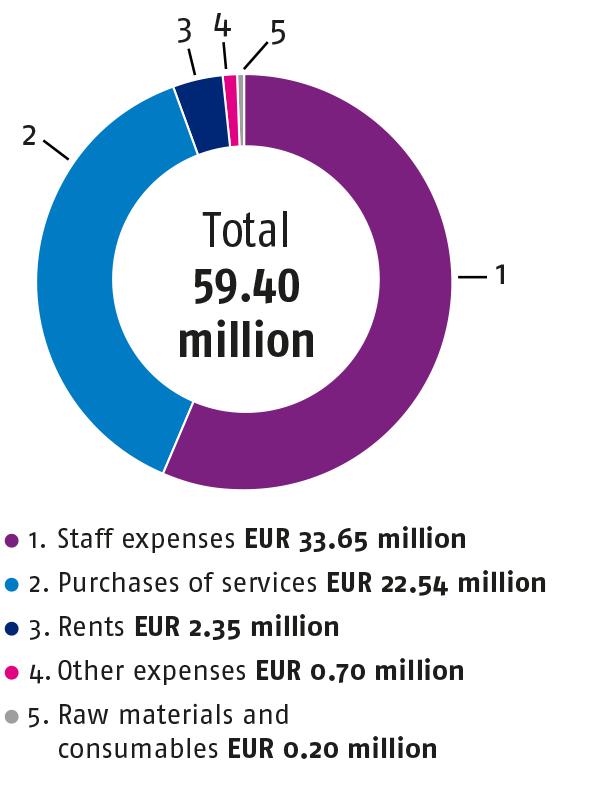

Expenditure structure in 2024

Expenditure without depreciation totalled €59.4 million in 2024 and was divided as follows:

- Staff expenses €33.65 million

- Purchases of services €22.54 million

- Rents €2.35 million

- Other expenses €0.70 million

- Raw materials and consumables €0.20 million

Balance sheet

The balance sheet item Other long-term expenditure (€26.2 million) concerns information systems needed in the operations. Of the other long-term expenditure, €17.4 million concerns systems of the Trade Register and the Register of Associations, €6.6 million systems to process patent and trademark applications, €1.3 million the order management system, and €600,000 other administrative systems.

Investments amounted to €9.8 million and they are included in the balance sheet under prepaid expenses and work in progress.

€7.1 million was spent on investments under the PRH item. In addition, investments from other items used by the PRH were funded as follows: €100,000 for combating money laundering, €1.4 million for developing the digitalisation of administration, €250,000 for developing the real-time economy and €900,000 for building a beneficial owner register.

Advances received consist of patent customers’ assets in the deposit account. The amount of advances received decreased by €740,000 from the previous year. The number of advances is affected by the timing of customer deposits and withdrawals at the turn of the year.

Accruals decreased by €250,000 million from the previous year. The decrease was mainly due to a decrease in internal accruals.